by Ronald J. Trubiana, ATG Senior Vice President and Chief Financial Officer EDITOR'S NOTE: This article is a companion to the ATG Legal Education program, Lawyer-Title Agent Escrow Accounts: Current Banking Issues, Fraud, Liability, and Internal Control

EDITOR'S NOTE: This article is a companion to the ATG Legal Education program, Lawyer-Title Agent Escrow Accounts: Current Banking Issues, Fraud, Liability, and Internal Control.

ATG Members and Staff: REGISTER FREE NOW — login required.

If someone you don’t know wants to pay you by check but wants you to wire some of the money back, beware! It’s a scam that will cost you thousands of dollars.

There are many variations of the fake check scam. It could start with someone offering to buy something you advertised, advancing you funds for real estate transactions, giving you an “advance” on a sweepstakes you’ve supposedly won, or paying the first installment on the millions that you’ll receive for agreeing to have money from a foreign country transferred to your bank account for safekeeping.

How They Find You

Fake check scammers hunt for victims. They find them using many methods, including:

-

Scanning newspaper and online advertisements for people listing items for sale;

-

Checking postings on online job sites from people seeking employment;

-

Placing their own ads with phone numbers or email addresses for people to contact them; and

-

Calling or sending emails or faxes to people randomly, knowing that some will take the bait.

They specifically look for lawyers and title companies who have escrow accounts — they know where the money is!

How They Scam You

Whatever the pitch, the person may sound quite believable. Scammers often claim to be in another country and that it’s too difficult and complicated to send you the money directly. Instead, they’ll arrange for someone in the U.S. to send you a check. After you’ve deposited the check, they tell you to wire money to them.

They use a similar scenario if you’re selling something. They arrange to pay you by having someone in the U.S. who owes them money send you a check. It will be for more than the sale price; you deposit the check, keep what you’re owed, and wire the rest to them.

If it’s part of a work-at-home scheme, they may claim that you’ll be processing checks from their “clients.” You deposit the checks and then wire them the money minus your “pay.” Or they may send you a check for more than your pay “by mistake” and ask you to wire them the excess.

In the sweepstakes and foreign money offer variations of the scam, they tell you to wire them money for taxes, customs, bonding, processing, legal fees, or other expenses that must be paid before you can get the rest of the money.

The checks are fake but they look real. In fact, they look so real that even bank tellers may be fooled. Some are phony cashiers checks, others look like they’re from legitimate business accounts. The companies whose names appear may be real, but someone has dummied up the checks without their knowledge.

You don’t have to wait long to use the money, but that doesn’t mean the check is good. Under Federal law, banks have to make the funds you deposit available quickly – usually within one to five days, depending on the type of check. But just because you can withdraw the money doesn’t mean the check is good, even if it’s a cashier’s check. It can take weeks for the forgery to be discovered and the check to bounce.

You are responsible for the checks you deposit. That’s because you’re in the best position to determine the risk. You’re the one dealing directly with the person who is arranging for the check to be sent to you. When a check bounces, the bank deducts the amount that was originally credited to your account. If there isn’t enough to cover it, the bank may either take money from other accounts you have at that institution or sue you to recover the funds. In some cases, law enforcement authorities may even bring charges against the victims because it may look like they were involved in the scam and knew the check was counterfeit.

Fraudsters bank on the fact that you will have significant float in your escrow account and, therefore, have available funds to accomplish their request for a return of funds. It's up to you to protect yourself!

What You Can Do

The first thing you need to do is determine whether or not a contact is legitimate. Look for the telltale signs that you are about to be scammed:

-

Grammatical errors

-

Poor sentence construction

-

Handwritten correction to email address

-

Suspicious company with no mailing address on letter

-

Amount of check in the letter doesn’t match the actual check

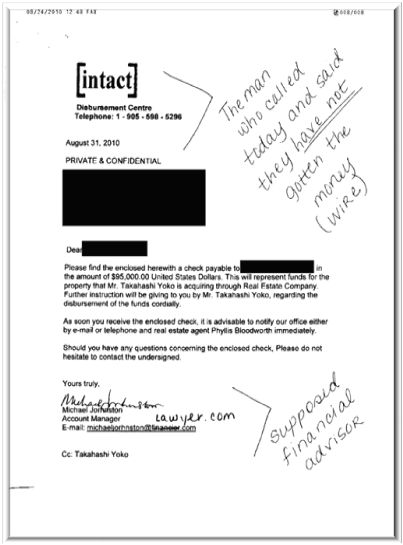

See below for an example of an actual letter received from a scammer:

Click image for larger view

Whether or not a contact is scamming you, the following steps are sound practice under any circumstances:

-

Train your employees to be diligent. Everyone in your office must know and watch for these signs of a scam.

-

Be cautious with international clients. Once funds are wired out of the country, recovery is impossible.

-

Ask yourself one question. Is it almost too good to be true? If the answer is Yes, then it probably is.

If you know or suspect that you are about to be scammed you have been a victim of a fraud scam, take the following steps immediately:

-

Stall as long as you can. The more you delay, the more anxious the fraudster becomes. You will be inundated with emails. The fraudster may suspect something and then cease communications.

-

Communicate with your bank. Let them know if you think something is not right with a transaction.

-

Notify law enforcement. Though they may be limited in what they can do, contact your local police and/or the FBI.

ATG Members: In all cases, contact ATG. We can help you sort through this.

Remember, there is no legitimate reason for someone who is giving you money to ask you to wire money back. If a stranger wants to pay you for something, insist on a cashiers check for the exact amount, preferably from a local bank or a bank that has a branch in your area. Under no circumstances do you wire any money back to the person until you have verified that the funds have cleared.